LIFETIME INCOME WITH ANNUITIES

ANNUITIES

Do angels provide Lifetime Income? YES!!

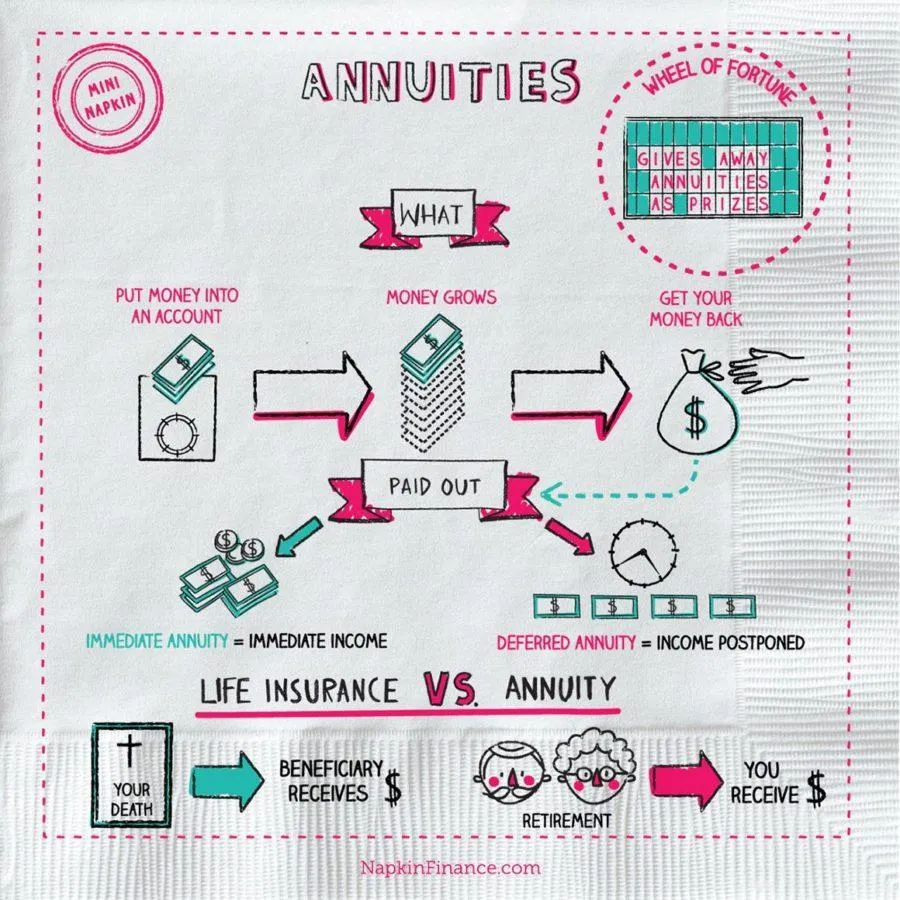

An annuity is a financial product that allows you to deposit money with an insurance company. The insurance company will then provide a series of payments back to you at regular intervals. You can use the annuity to supplement your retirement income from Social Security, pension benefits, investments, and other sources. You can convert your annuity into a stream of income that can then be paid over a fixed period or for your lifetime. You can take withdrawals of varying amounts when you need the income.

Kathy & Cong Tran

Protecting Your Retirement

An annuity is like a piggy bank that you give to a company. The company will then give you some of the money back every month. You can use the money to help you when you are older and not working anymore.

Guaranteed stream of income for life.

Living Benefits, Death Benefits, & Lifetime protection

Save and GROW your Retirement without Downside Risk

Tax-deferred growth.

Annuities can provide peace of mind.

WHO WE ARE

Our mission is to protect families and empower women. We understand the importance of safeguarding loved ones from potential financial disasters. Our products goes beyond traditional insurance policies, offering comprehensive coverage and personalized support. With a focus on trust, compassion, and empowerment, Financial Guardian Angel is a beacon of hope for women seeking to secure their family's future.

Join our Crusade!

Kathy & Cong Tran

ANNUITIES VIDEOS

Annuities Attacking Monsters

Education Ogre

Education is the key to a brighter future, but the monster of high educational costs can seem daunting. As a parent, you want to equip your child with the best opportunities for success, and funding their education is a significant part of that journey.

Critical Illness Beast

Critical illness can be a frightening monster, but it's important to equip your child with the knowledge and resilience to face it head-on. While we hope our children never have to confront such challenges, preparing them to navigate the uncertainties of critical illness is crucial.

Loss of Income Troll

The monster of loss of income due to sickness can be overwhelming for any family, but having living benefits can help empower your child and provide a safety net during this difficult time. Here's how your child can face the monster of loss of income, with the support of living benefits:

Cancer Critter

Facing the monsters of cancer and heart issues can be incredibly challenging, but it's important to empower your child with courage and resilience to overcome these obstacles.

Wacky Accident Giant

Accidents and disabilities can be daunting monsters, but it's essential to equip your child with the strength and resilience to face them head-on. While we hope our children never have to encounter such challenges, preparing them to navigate the uncertainties of accidents and disabilities is crucial.

Retirement Monster

The monster of saving for retirement may seem far off in the future, but it's never too early to start planning for your child's financial well-being. Indexed Universal Life (IUL) insurance can be a powerful tool to help your child face and overcome the challenge of saving for retirement.

FAQ About Annuities

How does taking money from my annuity or life insurance affect my Social Security?

Money taken from an annuity is considered earnings and is taxable as ordinary income and must be considered in determining the taxation of your Social Security benefits. Money received from an annuity that is a return on premiums paid, is received income tax-free and should not affect the taxation of Social Security benefits. Money taken from your life insurance policy through, a loan or withdrawal, generally are received income tax-free and should not affect the taxation of your Social Security benefits.

Will my beneficiary have to pay taxes on my annuity?

Yes, beneficiaries will be taxed on the tax-deferred interest when they receive those dollars. However, if a beneficiary is the spouse of the owner and the owner dies, he/she may elect to continue the annuity and postpone taxes. If the beneficiary is not the spouse and the owner dies, then the funds must be totally withdrawn within five years or they may be received over the beneficiary’s life expectancy, as long as the beneficiary elects this option within the first 12 months following the annuity owner’s death.

What are the benefits of an annuity?

The benefits of an annuity include principal protection, the potential for guaranteed lifetime income, and the option to leave money to your beneficiaries.

What are the different types of annuities?

There are three main types of annuities: fixed, fixed indexed, and variable. Fixed annuities offer a guaranteed interest rate and predictable payouts. Fixed indexed annuities offer a guaranteed minimum interest rate and the potential for higher returns based on the performance of an underlying index. Variable annuities offer the potential for higher returns but also carry greater risk because account growth is tied to an investment portfolio.