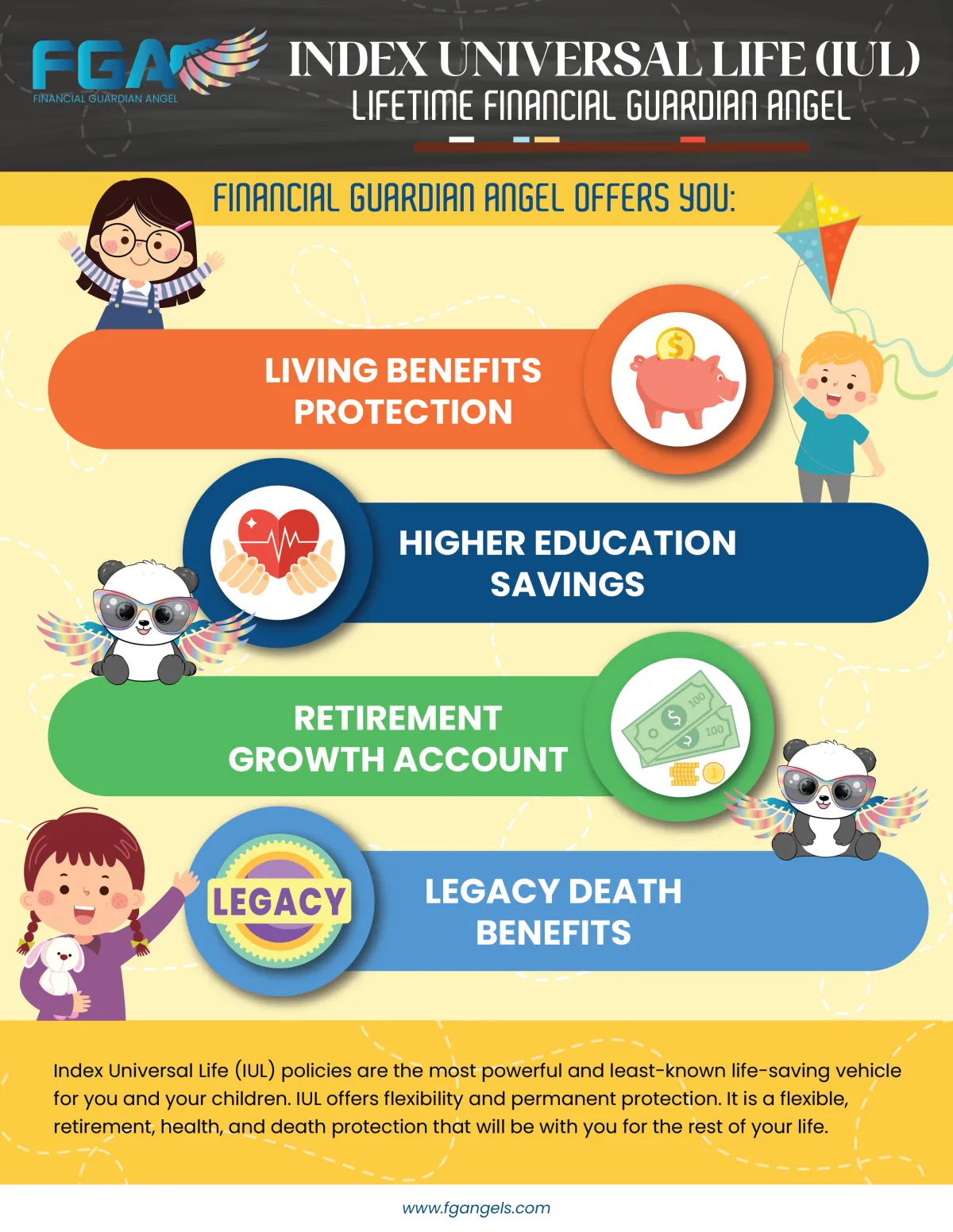

INDEX UNIVERSAL LIFE

YOUR LEGACY PROTECTED

Index Universal Life (IUL) For Families

Families love IULs because of their unique combination of benefits. They get life insurance coverage and the chance to grow through indexed returns, so they get the best protection. You can use this powerful financial tool to protect your family's future because it's flexible, tax-friendly, and a great safety net.

"Your angel is here to save the day!"

Kathy & Cong Tran

FEAR NOT- YOUR ANGEL IS HERE

Protecting your children with an IUL.

Discover the power of IUL for families, providing comprehensive financial protection and growth potential. Secure your family's future with Indexed Universal Life insurance tailored to your unique needs

Start early to Compound your family's protection

Lifetime Tax Advantages

Flexible & Powerful Financial Tool

Upside Growth with Downside Protection

Living Benefits provide comprehensive protection

IUL REAL LIFE EXAMPLE

IUL WITH LIVING BENEFITS

Protect and Defend your child.

A parent with young kids can use Indexed Universal Life (IUL) to build a large cash value and make sure that their family's future is secure. You can use it to start early and benefit from compounding. Don't wait, with living benefits, you can shield your loved ones from unexpected medical bills or accidents. Don't wait, get your family's legacy today.

Comprehensive Protection

Indexed Universal Life (IUL) with living benefits offers comprehensive protection as a major benefit. In addition to the death benefit that provides a financial safety net for your loved ones in case of your passing, living benefits allow you to access a portion of the death benefit while you're alive. You and your family are financially supported during challenging times, reducing the burden of medical expenses.

Potential for Growth

A major advantage of IULs with living benefits is their potential for growth. The cash value of the policy has the potential to accumulate over time based on the performance of the underlying index. As the index rises, your cash value will increase, providing you with additional funds you can use for various needs, such as funding your child's education or supplementing your retirement income.

Flexible for all life's events

IUL is a powerful, versatile, and flexible financial tool you can use for a variety of life events. You can use the funds accumulated in an IUL policy to buy your first house, make investments, plan for retirement, or act as your personal bank. Cash value growth can enable you to make a down payment on your dream home, invest in opportunities that align with your financial goals, secure a comfortable retirement, or borrow funds for personal emergency or needs.

"The best time to plant a tree was 20 years ago. The second best time is now." - Chinese Proverb

The best gift you can give your child is an Indexed Universal Life (IUL) policy. If you start it early, your child's cash value can grow and compound over time. Your child will have a better financial foundation as they grow up if they have more wealth accumulation potential. IUL is also a cost-effective solution since younger people generally qualify for better rates, so starting early lets you get lower premiums. You can lay the groundwork now for your kid's financial success and equip them with the tools they need to get through life's milestones.

Financial Monsters Every Child Will Face In Their Life

In today's unpredictable world, financial monsters such as rising education costs, unexpected medical expenses, and uncertain retirement loom over our children's dreams. But fear not, because this guide shows you the way to conquer these monsters and secure your child's future.

Education Ogre

Education is the key to a brighter future, but the monster of high educational costs can seem daunting. As a parent, you want to equip your child with the best opportunities for success, and funding their education is a significant part of that journey.

Critical Illness Beast

Critical illness can be a frightening monster, but it's important to equip your child with the knowledge and resilience to face it head-on. While we hope our children never have to confront such challenges, preparing them to navigate the uncertainties of critical illness is crucial.

Loss of Income Troll

The monster of loss of income due to sickness can be overwhelming for any family, but having living benefits can help empower your child and provide a safety net during this difficult time. Here's how your child can face the monster of loss of income, with the support of living benefits:

Cancer Critter

Facing the monsters of cancer and heart issues can be incredibly challenging, but it's important to empower your child with courage and resilience to overcome these obstacles.

Wacky Accident Giant

Accidents and disabilities can be daunting monsters, but it's essential to equip your child with the strength and resilience to face them head-on. While we hope our children never have to encounter such challenges, preparing them to navigate the uncertainties of accidents and disabilities is crucial.

Retirement Monster

The monster of saving for retirement may seem far off in the future, but it's never too early to start planning for your child's financial well-being. Indexed Universal Life (IUL) insurance can be a powerful tool to help your child face and overcome the challenge of saving for retirement.

FAQ Index Universal Life (IUL)

What is an IUL (Indexed Universal Life) policy and how does it work?

An Indexed Universal Life (IUL) policy is a type of permanent life insurance that combines a death benefit with a cash value component. It offers the policyholder the potential for cash value growth based on the performance of an underlying stock market index, such as the S&P 500. Discover more here.

What are the benefits of an IUL policy compared to other types of life insurance?

Understand the advantages of an IUL policy, such as flexibility in premium payments, potential for cash value growth, tax advantages, and the availability of living benefits that can provide financial protection in case of critical illness or chronic health conditions.

How can an IUL policy help secure my family's financial future?

Discover how an IUL policy can serve as a powerful tool for long-term financial planning, offering a death benefit to protect your loved ones and a cash value component that can be accessed for various needs, such as funding education, supplementing retirement income, or addressing unexpected expenses.